What are Binary Options?

Binary Options are very simple to understand and they are used because all they require is one decision: to predict whether a currency pair – or any other asset – will go up or down in value.

Binary Options are a form of options trading based on a single question: did a stock index, commodity or Forex pair reached a certain price or not – called the strike price – by a defined time period called the expiration. Once you choose one of the two options available the trade can begin.

“Call” and “Put” Binary Options

Generally speaking, there are two types of binary options:

- “Call” Options are a type of Binary Option used when you believe that a currency pair will rise.

- “Put” Options are opposite to the “Call” Options and are used when you believe that a currency pair will fall.

Expiration time in Binary Options

The expiration time is one of the most crucial elements to understanding when trading Binary Options because ultimately it will determine whether or not your trade will be successful. Trading Binary Options requires you not only to accurately predict whether a currency pair will rise or fall, but it has to be done so during a certain time frame – called the expiration time. If your forecast is valid by the time of the “expiration time” of the option contract you win, otherwise you’ll lose the initial investment entirely.

The Binary Options trade is fast and can last between 5-minutes up to 24 hours depending on your Broker. Once the time is up your position will be automatically be closed, if your prediction was right, you will profit between 60% and 90% of your initial investment. Let’s say for example that you place a Binary Option trade with $500 and the Binary Options payout associated with the position is 90%. If your prediction is right, you’ll win $450 on top of your initial investment.

Binary option expiration times vary from broker to broker, some will offer you fixed expiration times while other brokers will let the trader choose the expiry time. The Binary Option payout is also established by your own broker and can vary from broker to broker.

Top 5 Binary Options Strategy

Professional traders use different types of strategies depending on the market conditions we’re in. The primary focus of a Binary Options trader should be protecting your capital because when your trade doesn’t go in your direction you lose the initial investment capital. In this article, I will explain the most popular Binary Options strategies employed by the professional trader:

Trend Following

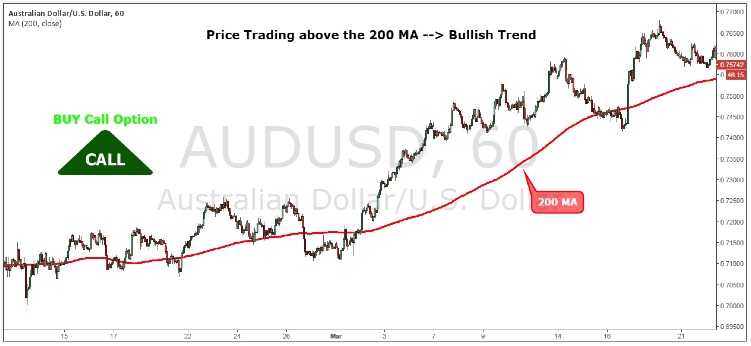

The trend following strategy is the simplest and one of the most popular and oldest strategies. Everyone knows that in order to make money you need a trend and the stronger the trend is, the more trading opportunities will be present. Before going forward, we need to learn how to determine the direction of the trend. A simple moving average (MA) can be used to determine the overall direction of the trend and the 200 MA is considered to be one of the most powerful moving averages.

If we’re trading below the 200 MA this is indicative of a bearish trend in which case we only want to buy PUT options.

If we’re trading above the 200 MA this is indicative of a bullish trend in which case we only want to buy CALL options.

Revision to the Mean Strategy

Reversion to the mean means that prices in the short-term tend to be very influenced by the trader’s greed and fear. Investor psychology is very important and when we have a sudden spike in price too far and too quickly the price has the tendency to reverse to its mean. In a strong trend, we can look for the prices to revert to the mean, and one of the best tools to measure the standard deviation is the Bollinger Bands, which will give you an opportunity to buy both Put and Call Options.

Whenever the price touches the upper Bollinger Band that can be a good opportunity to buy Put Option and respectively when the price touches the lower Bollinger Band that can be a good opportunity to buy Call Options.

Hedging Strategy

Hedging is a financial concept used to reduce the risk in the market. If you want to protect yourself against a negative event and reduce the impact, hedging is one of your best alternatives. Binary Option hedging strategy requires executing at the same time both a Put and a Call option. This is a non-directional trading strategy and you don’t have to accurately predict the direction of the market. This hedging method is also called “the straddle” and works best when the market moves inside a defined trading range.

Ranging Strategy

The market spends 80% of the time in consolidation and only 20% of the time in trading mode and that’s one of the reasons why range trading is so appealing. Range trading is a period of congestion where the price is bouncing between support and resistance. This strategy is quite simple – when the price hits support we buy Call Option in anticipation of a bounce and when the price hits resistance we buy Put Option in anticipation of a sell-off (see Figure below).

Figure 6: EUR/USD 1H Chart

Fundamental Analysis Strategy

If you have a good understanding and a strong grasp of Fundamental analysis and if you want to speculate around economic news releases, Binary Options are a great tool to take advantage of the market movements during the news events. If your Fundamental analysis tells you that the next US jobs report is going to beat the market expectation and EUR/USD is trading at some important resistance, it’s worth to buy a Put Option with a 5-minute expiration time. Usually, when trading news events you only want to speculate on the first 5-minute movement.