In financial markets, spread betting is a viable and practical alternative to regular trading which enables you to trade on whether you think a market will go up or down. If we really understand the fundamental basics of how spread betting works, then we can build from the ground up profitable strategy.

How traders make money?

First of all, traders make money by capitalizing on the up and down market oscillations. This market can be either a currency pair, a global index, gold, oil or a stock. Traders can make money attempting to buy and sell higher – going long, or by selling and buying back lower – going short. So, whichever way the markets are moving we are attempting to capture those moves.

Types of Trading

There are different types of trading thus different types of spread betting strategies that one can use. Depending on the type of trader you are we can distinguish four types of trading:

- Scalping: Taking very small, quick profits from the market.

- Daytrading: Trading in and out of a market or several markets many times a day.

- Swing Trading: Trading over a period of several days, weeks or months.

- Investing: Buying for the long-term.

Spread Betting Trading Example

Let’s say you want to trade the German Stock Index DAX at the current market price 12,700. You expect the DAX index to rise and you bet on that outcome. The stake is $10 for every point of the index. For every point it goes up you make $10 and conversely for every point it goes down you lose $10.

Winning Scenario:

As you hoped, the DAX index rises. When the index reaches 12,900 you decide to take your profits so you sell and liquidate your position.

Results:

- Your profit is the difference and therefore 12,900-12,700= 200 points

- 200 points X 10 stake = $2,000 profit.

Loosing Scenario:

The DAX index falls. When the index reaches 12,600 you decide to cut your losses and pull out.

Results:

- Your loss is the difference and therefore 12,700-12,600= 100 points

- 100 points X 10 stake = $1,000 loss

Advanced Spread Betting Strategies

Experienced spread betting traders know that in order to succeed in this business, you need a clear strategy otherwise you’re just gambling. If you have not yet developed your own strategy than hopefully, this guide can help you to get started. This are advanced spread betting techniques that can be used on their own or can be incorporated into your own system.

News Spread Betting Strategies:

Fundamental analysis largely comes to us through the news, so news trading is very economical centered. News trading can be very predictable, but this doesn’t necessarily mean we’ll know what the news will be and instead only that we know when the news will come out.

Dividend announcements and earning reports for particular stocks are considered good opportunities for spread betters, as with these we can generally predict that there is going to be market volatility which is great for spread betting.

In the below example, Apple is about to announce its earnings for the 1st quarter of 2017 and there is a good probability of a positive number. In this case, a spread betting trader will use this opportunity to his advantage and bet on Apple stock rising.

Apple was trading at 145.00 before earning announcement. The stake is 1,000 shares at 145.00, with $1 per point move. For every point it goes up you make $1,000 ($1*1,000shares) and conversely, for every point it goes down, you lose $1,000. The outcome is that Apple stock rises to 154.00 netting you a nice profit of $9,000

Spread Betting Trading Example for Apple Computers

Arbitrage Spread Betting Strategies:

Arbitrage occurs when a trader simultaneously buys and sells an asset in an attempt to benefit from an existing price difference on similar or identical securities. For example, one spread betting firm is offering Twitter stock at a bid-ask spread of 20-21, while another spread betting firm is offering an 18-19 spread. To make a risk free profit ideally you would want to sell the more expensive market and you would want to buy in the less expensive market. So the trader goes short at 20 and long with the other firm at 19, each with $100 per point.

- Scenario #1: Twitter closes at 25. You lose $500 (25-20=5*$100=$500) on the short but gain $600 (25-19=6*$100=$600) on the long position.

- Scenario #2: Twitter goes at 15. You gain $500 (20-15=5*$100=$500) on the short but lose $400 (19-15=4*$100=$400) on the long position.

Pyramiding and Spread Betting Strategies:

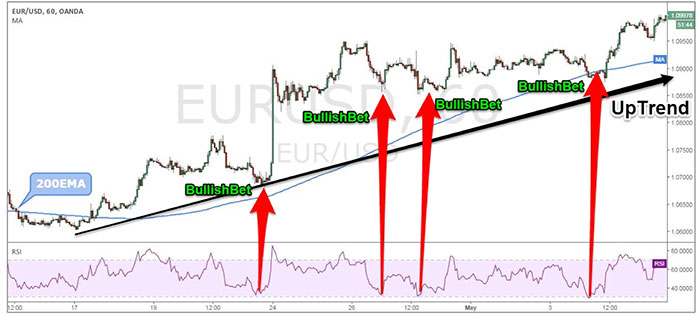

Pyramid trading is a strategy that involves adding into a winning position. The benefit of spread betting pyramiding is that allows maximizing the potential profits. A simple and yet effective strategy to apply pyramiding is to first identify a strong trend and then only bet on the direction of the trend. The way to identify a trend is to use a moving average like the 200MA which is regarded the most trusted MA. The way to enter the trend is to use an overbought/oversold indicator like the RSI indicator and in a bullish trend only take bets to the upside when the RSI is in oversold territory. The same rules apply when we’re in a bearish trend.

Conclusion

Remember that not every strategy is suitable for everyone. What works for someone doesn’t necessarily mean it must work for everyone so you’ll have to find your own approach to spread betting. The bottom line is that if you take in the necessary time to develop your own spread betting strategy there is a potential to really find success in this business but the success is matched by the inherent spread betting risk.